Montgomery claims to critique Barack Obama's tax proposals. However, she doesn't even describe them accurately. In particular she leaves out the proposal to extend FICA to individual wage and salary income over $250,000.

Here is all of her discussion of Obama's proposals

On the presidential campaign trail, Democrat Barack Obama promises to "completely eliminate" income taxes for millions of Americans, from low-income working families to senior citizens who earn less than $50,000 a year.

[snip]

Obama has not made balanced budgets a priority. Instead, he promises numerous tax cuts likely to make the situation worse, including subsidies for education, child care, homeownership, "savers" and people who work. Obama also vows to extend the Bush tax cuts for families who earn less than $250,000 a year. According to an analysis by the Tax Policy Center, a joint project of Brookings and the Urban Institute, his tax plans would deprive the Treasury of nearly $900 billion in his first term, and increase the national debt by $3.3 trillion by 2018.

That analysis excludes some expensive proposals, including promises to close the gap in prescription drug coverage for Medicare recipients (estimated to cost about $400 billion over 10 years); to introduce government-funded health insurance for the uninsured (which the campaign estimates would cost as much as $65 billion a year); and to make large-scale investments in energy, education and infrastructure, which Obama dubbed his "competitiveness agenda" during a speech this week in Flint, Mich.

The analysis also excludes a possible reduction in corporate tax rates, which Obama first mentioned in an interview this week with the Wall Street Journal. Campaign officials said Obama would pay for the rate reduction by closing corporate tax loopholes.

Note there is no mention of the FICA increase. Now part of the blame belongs to the Tax Policy Center which performed a huge amount of analysis and left that little bit out.

The amount of money involved is gigantic -- roughly on the order of the cost of the making work pay tax cut ($500 per individual or $1,000 per family phased out so going to zero at family income over $70,000).

I think the point is that social security taxes don't count as taxes (just like military spending doesn't count). That's how Reagan can be remembered as a tax cutter in spite of the huge FICA tax increase he signed into law.

This goes both ways. Since one isn't supposed to use the social security surplus to balance the deficit in the general fund, Obama's huge tax increase goes unmentioned.

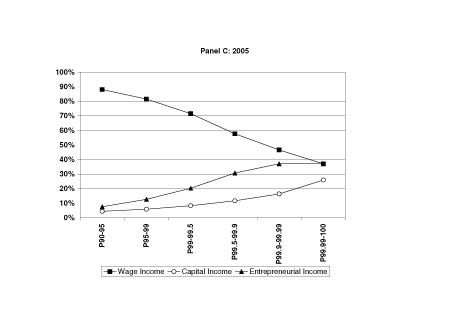

I think there is also the fact that people assume that the income of the rich is capital income not labor income. This is simply false. In 2005 wage and salary income of the richest 0.01% was greater than their capital income (warning huge spreadsheet click the big read "UPDATED" and wait a while then go to figure 4)

Another huge chunk is "business income" including partnership shares and S-corporate income. Some of it is subject to FICA and some isn't. It isn't really even worth trying to figure out what fraction is currently subject to FICA, because if Obama's reform passes, less will be as lawyers and accountants figure out how to profitably redefine enterprises.

For tax units from the 99th through the 99.99th percentile it isn't even close. More than half of their income is wage and salary income.

No comments:

Post a Comment